Samsung expands its popular GALAXY Tab range (0)

5/23/12 •

Samsung Electronics Co., Ltd, the leading mobile device provider, today announced the launch of Samsung GALAXY Tab 2 310 expanding its popular GALAXY range.

Recent Posts

Motorola Mobility previews what your TV will look like in the future (0)

5/22/12 •

Next-generation TV has arrived. At The Cable Show in Boston (May 21-23, Booth #733), Motorola Mobility, Inc. (NYSE: MMI) is showcasing the revolutionary entertainment discovery experience that will be launching in North American homes later this year.

ASUS launches first Intel® Thunderbolt™ Certified Motherboard (0)

5/22/12 •

Further demonstrating its market leading innovation, ASUS has announced the launch of its P8Z77-V PREMIUM motherboard — the flagship of the P8Z77 Series and the first Intel certified motherboard in the market to offer the latest Thunderbolt connection interface.

Samsung’s Interactive Smart TV Debuts in India (1)

5/18/12 •

Digital technology leader, Samsung Electronics, today announced the launch of its new, more interactive and intuitive Smart TV models – its flagship LED ES8000 and ES7500 series and the Plasma E8000 series in the Indian market.

Go Tech unveils two fun learning Tablet PCs in India (Comments Off)

5/18/12 •

Go Tech Digital Pvt. Ltd, today launched two fully loaded and powerful Tablet PCs which have preloaded Education and Fun applications which run on Android.

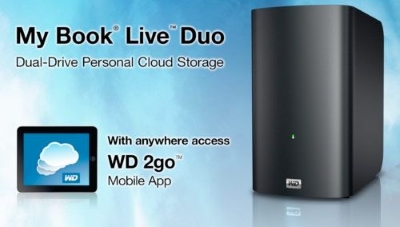

WD launches My Book Live Duo Personal Cloud Storage (Comments Off)

5/18/12 •

Western Digital (NYSE: WDC), the world’s leader in digital storage solutions, today introduced My Book Live Duo, a personal cloud storage system that combines the benefits of shared storage and remote access with double-safe backup or increased capacity of a dual-drive system with RAID (Redundant Array of Independent Disks) technology.

Garmin® enters mass market with nüvi 40LM and 50LM (Comments Off)

5/17/12 •

Garmin Corporation, a unit of Garmin Ltd., the global leader in satellite navigation, today entered the mass market with the launch of nüvi 40LM and 50LM devices.

Nokia introduces new mobile phones to provide a fast, affordable internet experience (2)

5/16/12 •

Nokia has today unveiled two new mobile phone models as it continues to accelerate its strategy to connect the next billion consumers to information and the internet.

RIM introduces a new BlackBerry Smartphone for India (0)

4/19/12 •

Research In Motion (RIM) (NASDAQ: RIMM; TSX: RIM) today announced its most affordable BlackBerry® 7 smartphone for customers in India.

Logitech Creates a More Touchable World With Logitech Touch Mouse M600 (Comments Off)

5/11/12 •

Today Logitech (SIX: LOGN) (NASDAQ: LOGI), the world’s leading manufacturer of mice, unveiled the Logitech® Touch Mouse M600, a mouse featuring a touch surface that lets you navigate intuitively with your fingers.

ASUS Reveals the GeForce® GTX 670 DirectCU II TOP Graphics Card (1)

5/11/12 •

The self-designed ASUS GeForce® GTX 670 DirectCU II TOP brings NVIDIA® 28nm “Kepler” GPU technology to a wider audience while maintaining extreme gaming performance.

Logitech Sets its Sights on Night Vision with New Indoor Master Security System and Add-On Camera (1)

5/10/12 •

Today Logitech (SIX: LOGN) (NASDAQ: LOGI) expanded its Logitech® Alert™ lineup by introducing the Logitech® Alert™ 750n Indoor Master System, a complete video security system in a box that enables you to be there – even when you’re not. Easy installation, wide-angle night vision, powerful PC software and a free remote viewing account let you rest at ease whether at home or away, with peace of mind that your property and loved ones are safe.

The Return of True Style with Motorola GLEAM™+ (3)

4/26/12 •

Motorola Mobility España SL introduces Motorola GLEAM™+, the slimmer, sleeker version of 2011’s elegantly designed and award-winning* flip phone for the style conscious.

Featured Categories

Apple»

-

3/09/12 •

Apple launches new iPad -

11/02/11 •

GarageBand now available for iPhone and iPod touch Users -

8/26/11 •

Steve Jobs resigns as CEO of Apple -

7/21/11 •

Apple introduces world’s first Thunderbolt Display -

7/21/11 •

Mac OS X Lion available today from the Mac App Store

Audio-Video»

-

5/18/12 •

Samsung’s Interactive Smart TV Debuts in India -

3/28/12 •

Jabra launches UC Voice Series Headsets -

2/28/12 •

NXP Software demonstrates LifeVibes smart player solutions -

1/10/12 •

Sony delivers new Google TV devices at CES -

12/20/11 •

Zebronics introduces Powerful 2.1 Mega Bass Multimedia Speakers

Gaming»

-

12/22/11 •

Angry Birds on BlackBerry PlayBook -

12/16/11 •

Disney introduces a brand new menu of exciting mobile games -

3/03/11 •

ASUS Unveils a Complete Portfolio of Gaming Products -

1/11/11 •

XFX introduces new Weapons in its ever-growing Arsenal -

1/11/11 •

Gamer’s Dream Windows 7 Tablet PC launched at CES 2011

Internet»

-

3/01/12 •

Huawei Announces SoftMobile Solutions to Build Efficient Mobile Broadband Connections -

3/01/12 •

Huawei introduces the world’s first Mobile Broadband Cloud Acceleration Solution -

2/22/12 •

McAfee Q4 Threats Report Shows Malware Surpassed 75 Million Samples in 2011 -

12/22/11 •

Sify Technologies launches Sify mystorage -

12/22/11 •

McAfee warns consumers of the “Twelve Scams of Christmas”

Mobile»

-

5/23/12 •

Samsung expands its popular GALAXY Tab range -

5/17/12 •

Garmin® enters mass market with nüvi 40LM and 50LM -

5/16/12 •

Nokia introduces new mobile phones to provide a fast, affordable internet experience -

5/10/12 •

SAMSUNG introduces the GALAXY S III, the Smartphone Designed for Humans and Inspired by Nature -

5/10/12 •

RIM introduces the BlackBerry Curve 9320

Photography»

-

3/06/12 •

Canon U.S.A. announces the highly anticipated EOS 5D Mark III Digital SLR camera -

1/17/12 •

JVC unveils world’s first Handheld 4K Camcorder -

1/11/12 •

Canon introduces Powershot Digital Camera, The G1 X, and Feature-Packed ELPH Series Cameras -

1/11/12 •

Canon brings six VIXIA High Definition flash memory camcorders -

1/11/12 •

Toshiba unveils three new powerful, yet affordable CAMILEO Camcorders

Windows»

-

11/06/09 •

Windows 7 outsells Vista in just two weeks! -

10/28/09 •

Qualcomm Powers Next-Generation Windows Phones

Blog Entries • Comments

Blog Entries • Comments